Affiliate marketing • Ai • Blockchain • Chrome Extension • Comparison • Content Writing • Email Marketing • FAQ • NFTs • PLR • review • Tool • Wordpress

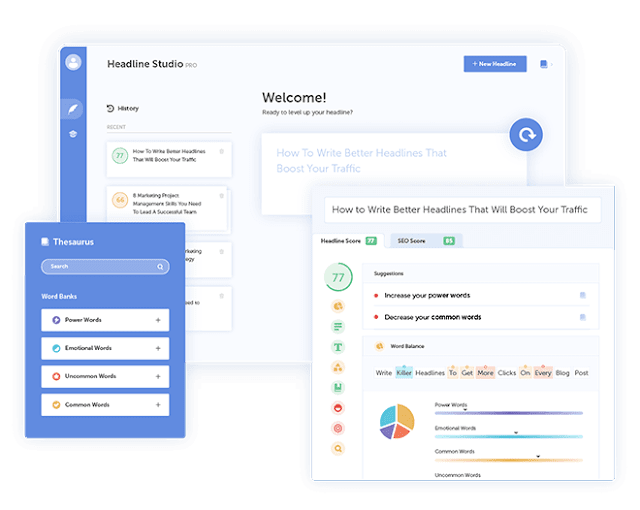

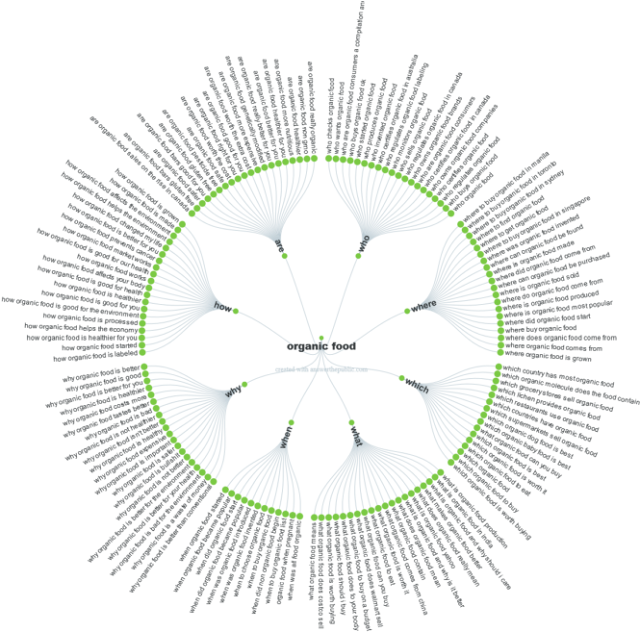

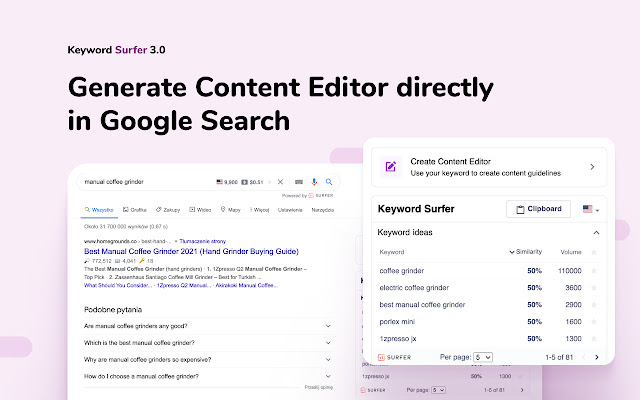

Looking to level up your content creation game in 2025? You're in the right place! The digital landscape has evolved dramatically, and AI tools have become essential for creators who want to stay ahead of the curve. In this guide, I'll show you the top 10 AI tools that are revolutionizing content creation and making creators' lives easier. Why You Need These AI Tools in 2025 Content creation has become more demanding than ever. Whether you're a social media influencer, marketer, or business owner, keeping up with the constant need for fresh, engaging content can be overwhelming. That's where AI tools come in – they're not just fancy tech, they're your secret weapon for creating better content faster. Let's Dive Into the Top 10 AI Tools for 2025 1. ChatGPT: Content Ideation and ScriptwritingWhat Makes It Special: ChatGPT has evolved into a comprehensive content creation assistant by combining advanced language understanding with specialized content optimization features. Its ability to generate, edit, and optimize content while maintaining brand voice and industry expertise makes it an essential tool for creators who need to produce high-quality written content at scale. Key Features:

Pricing:

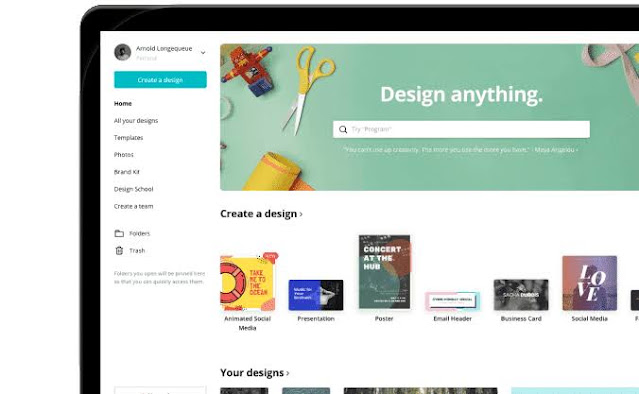

Perfect For: Content writers, marketers, and businesses needing consistent, high-quality written content.2. Canva Magic Studio: Visual Design and Social Media Content CreationWhat Makes It Special: Canva Magic Studio has transformed the graphic design landscape by combining its user-friendly interface with powerful AI capabilities. The platform's ability to understand design principles and automatically generate on-brand content while maintaining professional aesthetics makes it accessible for beginners while providing enough sophistication for professional designers. Key Features:

Pricing:

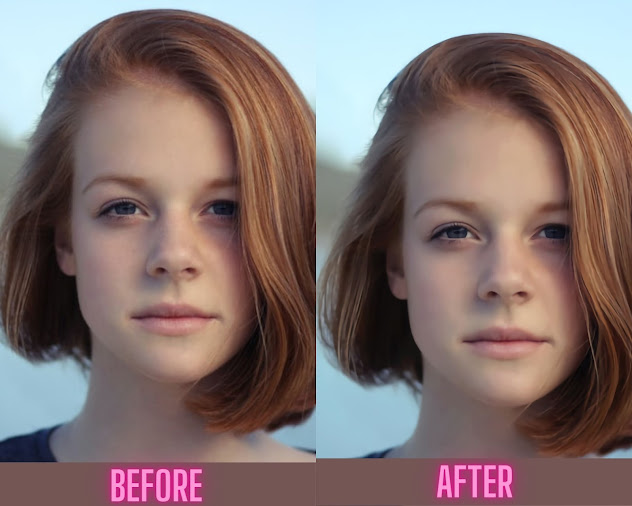

Perfect For: Small businesses, social media managers, and anyone needing quick, professional-looking designs. 3. RunwayML : AI Video GeneratorWhat Makes It Special: RunwayML stands out as the ultimate video creation powerhouse by combining professional-grade effects with user-friendly AI technology. Its game-changing ability to manipulate video content – from changing weather effects with a text prompt to removing objects seamlessly in real-time – makes it indispensable for creators who want to produce high-quality video content without getting bogged down by technical complexities. Key Features:

Pricing:

Perfect For: Video creators, YouTubers, and social media managers who want to create professional-quality videos quickly. 4. MidJourney: AI Art GenerationWhat Makes It Special: Midjourney V6 has redefined AI image generation by mastering the nuances of professional photography and artistic style. Its ability to understand and execute complex creative directions – from specific lighting conditions to branded visual styles – while maintaining consistent quality across multiple generations makes it the go-to tool for creators who need stunning visuals that align perfectly with their brand identity. Key Features:

Pricing:

Perfect For: Social media managers, digital marketers, and anyone needing professional-quality visuals consistently. 5. Synthesia: AI Avatar-Based Video CreationWhat Makes It Special: Synthesia has transformed video creation by making it possible to create professional-looking AI avatar videos in minutes. Its ability to generate natural-looking presentations in multiple languages with synchronized lip movements and gestures makes it invaluable for creators who need to produce video content at scale without the traditional filming process. Key Features:

Pricing:

Perfect For: Businesses and educators creating training videos, presentations, and multilingual content. 6. Descript: Podcast and Video Editing with Transcription FeaturesWhat Makes It Special: Descript has transformed audio and video editing by making it as simple as editing a text document. Its innovative approach to media editing, combined with powerful AI features like automatic transcription and filler word removal, makes professional-quality editing accessible to creators of all skill levels. Key Features:

Pricing:

Perfect For: Podcasters, video creators, and teams needing efficient audio/video editing solutions. 7. ElevenLabs: AI VOICE GENERATIONWhat Makes It Special: ElevenLabs has revolutionized voice synthesis by achieving unprecedented levels of natural speech quality and emotional expression. Its ability to clone voices accurately and generate multiple languages with proper accents and inflections makes it the ultimate tool for creators who need professional-quality voiceovers without the traditional recording process or voice actor limitations. Key Features:

Pricing:

Perfect For: Podcasters, video creators, and content creators needing professional voiceovers in multiple languages. 8. Tribescaler: Viral Content and Headline OptimizationWhat Makes It Special: Tribescaler brings a scientific approach to viral content creation by combining trend analysis with content optimization. Its powerful AI engine analyzes successful content patterns across platforms and provides actionable insights to help creators craft content that's more likely to go viral, while maintaining authenticity and audience engagement. Key Features:

Pricing:

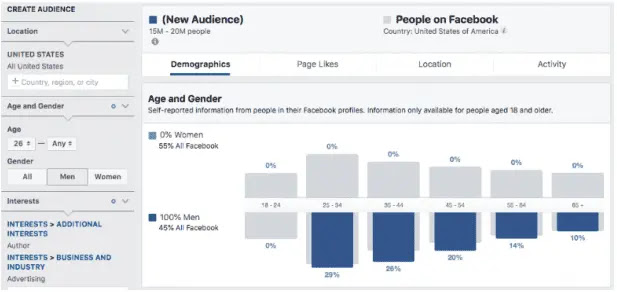

Perfect For: Content creators and social media managers focused on maximizing reach and engagement. 9. Clickable: Automated Ad Creation and OptimizationWhat Makes It Special: Clickable revolutionizes ad creation by seamlessly blending data-driven insights with creative automation. Its ability to analyze brand assets and automatically generate platform-optimized ad variations while maintaining brand voice transforms the tedious process of ad creation into a streamlined, results-driven workflow that consistently delivers high-performing content. Key Features:

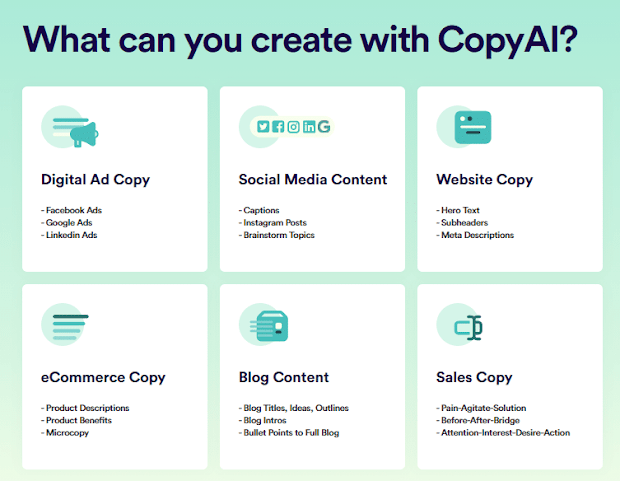

Perfect For: Digital marketers and businesses looking to scale their ad production efficiently. 10. Copy AIWhat Makes It Special: CopyAI has established itself as a powerhouse in AI-powered copywriting by offering specialized content generation for various marketing formats. Its sophisticated understanding of marketing psychology and brand voice, combined with its ability to generate compelling copy across multiple formats and industries, makes it invaluable for marketers and content creators who need to produce engaging, conversion-focused content at scale. Key Features:

Pricing:

Perfect For: Marketing teams, copywriters, and businesses needing high-converting marketing copy across multiple channels. ConclusionThe AI tools listed here are revolutionizing the content creation landscape in 2025, making it easier than ever to produce high-quality, engaging, and impactful content. By integrating these tools into your workflow, you can save time, unleash your creativity, and achieve better results. AI doesn't replace creativity; it amplifies it. As a content creator, your unique voice and vision are irreplaceable. These tools serve as enablers, helping you focus on what you do best—creating. Explore, experiment, and innovate. The future of content creation is here, and it's brimming with possibilities. Embrace these technologies, stay ahead of the curve, and watch your creative potential soar. The only limit is your imagination! Note:All features and pricing information are subject to change. Please verify current details with the respective platforms, Also this article contain affiliate links which means we make a small comission if yo buy any premium plan from our links Pricing updated on 01/02/ 2025Медиа: | ↑ |

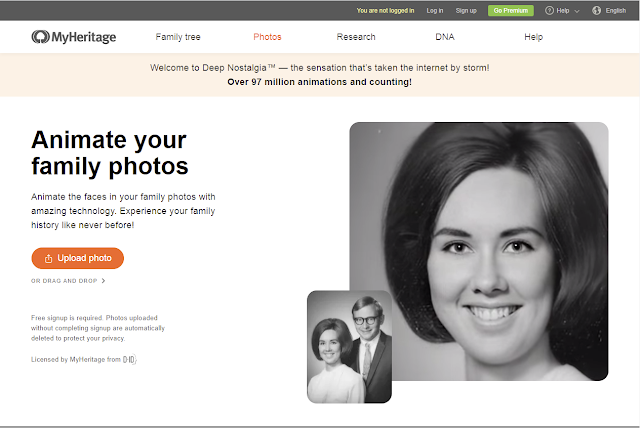

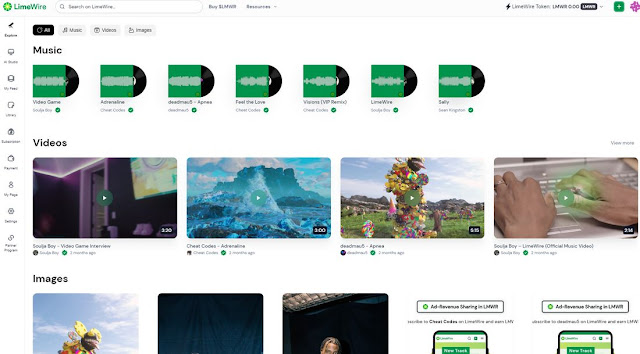

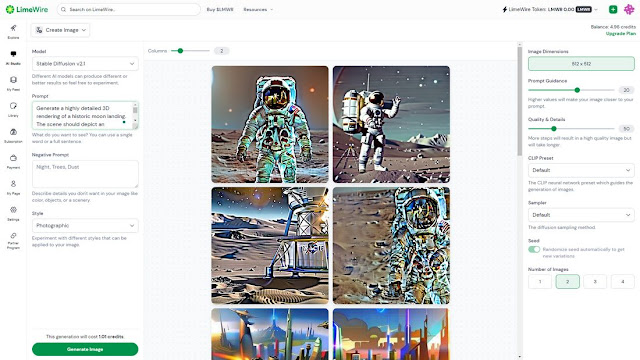

In the rapidly advancing landscape of AI technology and innovation, LimeWire emerges as a unique platform in the realm of generative AI tools. This platform not only stands out from the multitude of existing AI tools but also brings a fresh approach to content generation. LimeWire not only empowers users to create AI content but also provides creators with creative ways to share and monetize their creations. As we explore LimeWire, our aim is to uncover its features, benefits for creators, and the exciting possibilities it offers for AI content generation. This platform presents an opportunity for users to harness the power of AI in image creation, all while enjoying the advantages of a free and accessible service. Let's unravel the distinctive features that set LimeWire apart in the dynamic landscape of AI-powered tools, understanding how creators can leverage its capabilities to craft unique and engaging AI-generated images. IntroductionThis revamped LimeWire invites users to register and unleash their creativity by crafting original AI content, which can then be shared and showcased on the LimeWire Studio. Notably, even acclaimed artists and musicians, such as Deadmau5, Soulja Boy, and Sean Kingston, have embraced this platform to publish their content in the form of NFT music, videos, and images. Beyond providing a space for content creation and sharing, LimeWire introduces monetization models to empower users to earn revenue from their creations. This includes avenues such as earning ad revenue and participating in the burgeoning market of Non-Fungible Tokens (NFTs). As we delve further, we'll explore these monetization strategies in more detail to provide a comprehensive understanding of LimeWire's innovative approach to content creation and distribution. LimeWire Studio welcomes content creators into its fold, providing a space to craft personalized AI-focused content for sharing with fans and followers. Within this creative hub, every piece of content generated becomes not just a creation but a unique asset—ownable and tradable. Fans have the opportunity to subscribe to creators' pages, immersing themselves in the creative journey and gaining ownership of digital collectibles that hold tradeable value within the LimeWire community. Notably, creators earn a 2.5% royalty each time their content is traded, adding a rewarding element to the creative process. The platform's flexibility is evident in its content publication options. Creators can choose to share their work freely with the public or opt for a premium subscription model, granting exclusive access to specialized content for subscribers. LimeWire AI StudioAs of the present moment, LimeWire focuses on AI Image Generation, offering a spectrum of creative possibilities to its user base. The platform, however, has ambitious plans on the horizon, aiming to broaden its offerings by introducing AI music and video generation tools in the near future. This strategic expansion promises creators even more avenues for expression and engagement with their audience, positioning LimeWire Studio as a dynamic and evolving platform within the realm of AI-powered content creation. AI Image Generation ToolsThe LimeWire AI image generation tool presents a versatile platform for both the creation and editing of images. Supporting advanced models such as Stable Diffusion 2.1, Stable Diffusion XL, and DALL-E 2, LimeWire offers a sophisticated toolkit for users to delve into the realm of generative AI art. Much like other tools in the generative AI landscape, LimeWire provides a range of options catering to various levels of complexity in image creation. Users can initiate the creative process with prompts as simple as a few words or opt for more intricate instructions, tailoring the output to their artistic vision. What sets LimeWire apart is its seamless integration of different AI models and design styles. Users have the flexibility to effortlessly switch between various AI models, exploring diverse design styles such as cinematic, digital art, pixel art, anime, analog film, and more. Each style imparts a distinctive visual identity to the generated AI art, enabling users to explore a broad spectrum of creative possibilities. The platform also offers additional features, including samplers, allowing users to fine-tune the quality and detail levels of their creations. Customization options and prompt guidance further enhance the user experience, providing a user-friendly interface for both novice and experienced creators. Excitingly, LimeWire is actively developing its proprietary AI model, signaling ongoing innovation and enhancements to its image generation capabilities. This upcoming addition holds the promise of further expanding the creative horizons for LimeWire users, making it an evolving and dynamic platform within the landscape of AI-driven art and image creation. Sign Up Now To Get Free Credits Automatically Mint Your Content As NFTsUpon completing your creative endeavor on LimeWire, the platform allows you the option to publish your content. An intriguing feature follows this step: LimeWire automates the process of minting your creation as a Non-Fungible Token (NFT), utilizing either the Polygon or Algorand blockchain. This transformative step imbues your artwork with a unique digital signature, securing its authenticity and ownership in the decentralized realm. Creators on LimeWire hold the power to decide the accessibility of their NFT creations. By opting for a public release, the content becomes discoverable by anyone, fostering a space for engagement and interaction. Furthermore, this choice opens the avenue for enthusiasts to trade the NFTs, adding a layer of community involvement to the artistic journey. Alternatively, LimeWire acknowledges the importance of exclusivity. Creators can choose to share their posts exclusively with their premium subscribers. In doing so, the content remains a special offering solely for dedicated fans, creating an intimate and personalized experience within the LimeWire community. This flexibility in sharing options emphasizes LimeWire's commitment to empowering creators with choices in how they connect with their audience and distribute their digital creations. After creating your content, you can choose to publish the content. It will automatically mint your creation as an NFT on the Polygon or Algorand blockchain. You can also choose whether to make it public or subscriber-only. If you make it public, anyone can discover your content and even trade the NFTs. If you choose to share the post only with your premium subscribers, it will be exclusive only to your fans. Earn Revenue From Your ContentAdditionally, you can earn ad revenue from your content creations as well. When you publish content on LimeWire, you will receive 70% of all ad revenue from other users who view your images, music, and videos on the platform. This revenue model will be much more beneficial to designers. You can experiment with the AI image and content generation tools and share your creations while earning a small income on the side. LMWR TokensThe revenue you earn from your creations will come in the form of LMWR tokens, LimeWire’s own cryptocurrency. Your earnings will be paid every month in LMWR, which you can then trade on many popular crypto exchange platforms like Kraken, ByBit, and UniSwap. You can also use your LMWR tokens to pay for prompts when using LimeWire generative AI tools. Pricing PlansYou can sign up to LimeWire to use its AI tools for free. You will receive 10 credits to use and generate up to 20 AI images per day. You will also receive 50% of the ad revenue share. However, you will get more benefits with premium plans.

For $9.99 per month, you will get 1,000 credits per month, up to 2 ,000 image generations, early access to new AI models, and 50% ad revenue share

For $29 per month, you will get 3750 credits per month, up to 7500 image generations, early access to new AI models, and 60% ad revenue share

For $49 per month, you will get 5,000 credits per month, up to 10,000 image generations, early access to new AI models, and 70% ad revenue share if (typeof atAsyncOptions !== 'object') var atAsyncOptions= []; atAsyncOptions.push({ 'key': '2060cf2f0491455d459b6b7a0ee275f3', 'format': 'js', 'async': true, 'container': 'atContainer-2060cf2f0491455d459b6b7a0ee275f3', 'params' : {} }); var script= document.createElement('script'); script.type= "text/javascript"; script.async= true; script.src= 'http' + (location.protocol=== 'https:' ? 's' : '') + '://www.topcreativeformat.com/2060cf2f0491455d459b6b7a0ee275f3/invoke.js'; document.getElementsByTagName('head')[0].appendChild(script);

For $99 per month, you will get 11,250 credits per month, up to 2 2,500 image generations, early access to new AI models, and 70% ad revenue share With all premium plans, you will receive a Pro profile badge, full creation history, faster image generation, and no ads. Sign Up Now To Get Free Credits ConclusionIn conclusion, LimeWire emerges as a democratizing force in the creative landscape, providing an inclusive platform where anyone can unleash their artistic potential and effortlessly share their work. With the integration of AI, LimeWire eliminates traditional barriers, empowering designers, musicians, and artists to publish their creations and earn revenue with just a few clicks. The ongoing commitment of LimeWire to innovation is evident in its plans to enhance generative AI tools with new features and models. The upcoming expansion to include music and video generation tools holds the promise of unlocking even more possibilities for creators. It sparks anticipation about the diverse and innovative ways in which artists will leverage these tools to produce and publish their own unique creations. For those eager to explore, LimeWire's AI tools are readily accessible for free, providing an opportunity to experiment and delve into the world of generative art. As LimeWire continues to evolve, creators are encouraged to stay tuned for the launch of its forthcoming AI music and video generation tools, promising a future brimming with creative potential and endless artistic exploration Медиа: | ↑ |

In this article, we explore the top 10 AI tools that are driving innovation and efficiency in various industries. These tools are designed to automate repetitive tasks, improve workflow, and increase productivity. The tools included in our list are some of the most advanced and widely used in the market, and are suitable for a variety of applications. Some of the tools focus on natural language processing, such as ChatGPT and Grammarly, while others focus on image and video generation, such as DALL-E and Lumen5. Other tools such as OpenAI Codex, Tabnine, Canva, Jasper AI,, and Surfer SEO are designed to help with specific tasks such as code understanding content writing and website optimization. This list is a great starting point for anyone looking to explore the possibilities of AI and how it can be applied to their business or project. So let’s dive into 1. ChatGPTChatGPT is a large language model that generates human-like

responses to a variety of prompts. It can be used for tasks such as language

translation, question answering, and text completion. It can

handle a wide range of topics and styles of writing, and generates coherent and

fluent text, but should be used with care as it may generate text that is

biased, offensive, or factually incorrect. Pros:

Cons:

Overall, ChatGPT is a powerful tool for natural language

processing, but it should be used with care and with an understanding of its

limitations. 2. DALL-EDALL-E is a generative model developed by OpenAI that is

capable of generating images from text prompts. It is based on the GPT-3 architecture,

which is a transformer-based neural network language model that has been

trained on a massive dataset of text. DALL-E can generate images that

are similar to a training dataset and it can generate high-resolution

images that are suitable for commercial use. Pros:

Cons:

Overall, DALL-E is a powerful AI-based tool for generating

images, it can be used for a variety of applications such as creating images

for commercial use, gaming, and other creative projects. It is important to

note that the generated images should be reviewed and used with care, as they

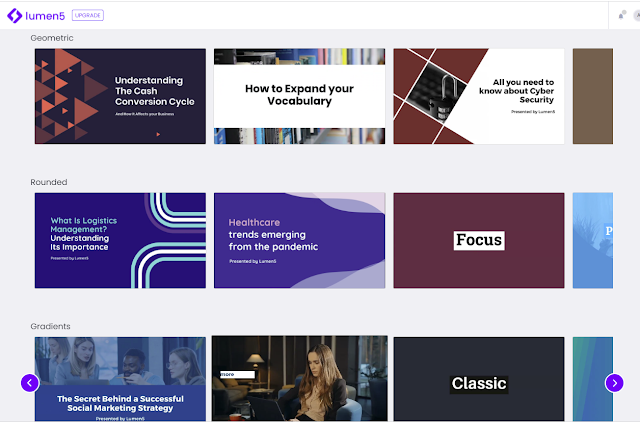

may not be entirely original and could be influenced by the training data. 3. Lumen5Lumen5 is a content creation platform that uses AI to help

users create videos, social media posts, and other types of content. It has

several features that make it useful for content creation and marketing,

including: Pros:

Cons:

Overall, Lumen5 is a useful tool for creating content

quickly and easily, it can help automate the process of creating videos, social

media posts, and other types of content. However, the quality of the generated

content may vary depending on the source material and it is important to review

and edit the content before publishing it. 4. GrammarlyGrammarly is a writing-enhancement platform that uses AI to

check for grammar, punctuation, and spelling errors in the text. It also provides

suggestions for improving the clarity, concision, and readability of the text. It

has several features that make it useful for improving writing, including: Pros:

Cons:

5.OpenAI CodexOpenAI Codex is a system developed by OpenAI that can

create code from natural language descriptions of software tasks. The system is

based on the GPT-3 model and can generate code in multiple programming

languages. Pros:

Cons:

Overall, OpenAI Codex is a powerful tool that can help

automate the process of writing code and make it more accessible to

non-technical people. However, the quality of the generated code may vary

depending on the task description and it is important to review and test the

code before using it in a production environment. It is important to use the

tool as an aid, not a replacement for the developer's knowledge. 6. TabnineTabnine is a code completion tool that uses AI to predict

and suggest code snippets. It is compatible with multiple programming languages

and can be integrated with various code editors. Pros:

Cons:

Overall, TabNine is a useful tool for developers that can

help improve coding efficiency and reduce the time spent on writing code.

However, it is important to review the suggestions provided by the tool and use

them with caution, as they may not always be accurate or appropriate. It is

important to use the tool as an aid, not a replacement for the developer's

knowledge. 7. Jasper AIJasper is a content writing and content generation tool that uses artificial intelligence to identify the best words and sentences for your writing style and medium in the most efficient, quick, and accessible way. Pros:

Cons:

8. Surfer SEO Surfer SEO is a software tool designed to help website

owners and digital marketers improve their search engine optimization (SEO)

efforts. The tool provides a variety of features that can be used to analyze a

website's on-page SEO, including: Features:

Pros:

Cons:

Overall, Surfer SEO can be a useful tool for website owners

and digital marketers looking to improve their SEO efforts. However, it is

important to remember that it is just a tool and should be used in conjunction

with other SEO best practices. Additionally, the tool is not a guarantee of

better ranking. 9. ZapierZapier is a web automation tool that allows users to

automate repetitive tasks by connecting different web applications together. It

does this by creating "Zaps" that automatically move data between

apps, and can also be used to trigger certain actions in one app based on

events in another app. Features:

Pros:

Cons:

Overall, Zapier is a useful tool that can help users

automate repetitive tasks and improve workflow. It can save time and increase

productivity by connecting different web applications together. However, it may

require some technical skills and some features may require a paid

subscription. It is important to use the tool with caution and not to rely too

much on it, to understand the apps better. 10. Compose AICompose AI is a company that specializes in developing

natural language generation (NLG) software. Their software uses AI to

automatically generate written or spoken text from structured data, such as

spreadsheets, databases, or APIs. Features:

Pros:

Cons:

Overall, Compose AI's NLG software can be a useful tool for

automating the process of creating written or spoken content from structured

data. However, the quality of the generated content may vary depending on the

data source, and it is essential to review the generated content before using

it in a production environment. It is important to use the tool as an aid, not

a replacement for the understanding of the data. ConclusionAI tools are becoming increasingly important in today's

business and technology landscape. They are designed to automate repetitive

tasks, improve workflow, and increase productivity. The top 10 AI tools

included in this article are some of the most advanced and widely used in the

market, and are suitable for various applications. Whether you're looking

to improve your natural language processing, create high-resolution images, or

optimize your website, there is an AI tool that can help. It's important to

research and evaluate the different tools available to determine which one is

the best fit for your specific needs. As AI technology continues to evolve,

these tools will become even more powerful and versatile and will play an even

greater role in shaping the future of business and technology. Медиа: | ↑ |

Are you looking for a way to create content that is both effective and efficient? If so, then you should consider using an AI content generator. AI content generators are a great way to create content that is both engaging and relevant to your audience. There are a number of different AI content generator tools available on the market, and it can be difficult to know which one is right for you. To help you make the best decision, we have compiled a list of the top 10 AI content generator tools that you should use in 2022. So, without further ado, let’s get started! 1. Jasper Ai(Formerly known as Jarvis)Jasper is a content writing and content generation tool that uses artificial intelligence to identify the best words and sentences for your writing style and medium in the most efficient, quick, and accessible way. Features

Pros

Cons

Pricing

Features:

Boss Mode: $99/Month Features:

Wait! I've got a pretty sweet deal for you. Sign up through the link below, and you'll get ( 10k Free Credits)2. Copy AiThe utility of this service can be used for short-term or format business purposes such as product descriptions, website copy, market copy, and sales reports. Key Features:

Pros

Cons

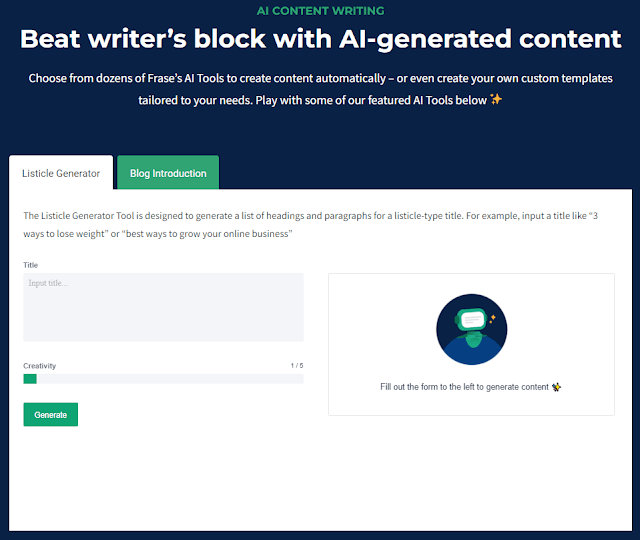

PricingFree Trial – 7 days with 24/7 email support and 100 runs per day. Pro Plan: $49 and yearly, it will cost you $420 i.e. $35 per month. Wait! I've got a pretty sweet deal for you. Sign up through the link below, and you'll get ( 7,000 Free Words Plus 40% OFF) if you upgrade to the paid plan within four days. Claim Your 7,000 Free Words With This Special Link - No Credit Card Required 3. Frase AiJust like Outranking, Frase is an AI that helps you research, create and optimize your content to make it high quality within seconds. Frase works on SEO optimization where the content is made to the liking of search engines by optimizing keywords and keywords. Features:

Pros

Cons

PricingFrase provides two plans for all users and a customizable plan for an enterprise or business.Solo Plan: $14.99/Month and $12/Month if billed yearly with 4 Document Credits for 1 user seat. Basic Plan: $44.99/month and $39.99/month if billed yearly with 30 Document Credits for 1 user seat. Team Plan: $114.99/month and $99.99/month if billed yearly for unlimited document credits for 3 users. *SEO Add-ons and other premium features for $35/month irrespective of the plan. 4. Article Forge — Popular Blog Writing Software for Efficiency and AffordabilityArticle Forge is another content generator that operates quite differently from the others on this list. Unlike Jasper.ai, which requires you to provide a brief and some information on what you want it to write this tool only asks for a keyword. From there, it’ll generate a complete article for you. Features

Pros

Cons

PricingWhat’s excellent about Article Forge is they provide a 30-day money-back guarantee. You can choose between a monthly or yearly subscription. Unfortunately, they offer a free trial and no free plan: Basic Plan: $27/Month Features:This plan allows users to produce up to 25k words each month. This is excellent for smaller blogs or those who are just starting. Standard Plan: $57/month) Features:

Unlimited Plan: $117/month Features:

It’s important to note that Article Forge guarantees that all content generated through the platform passes Copyscape. 5. Rytr — Superb AI Content Writing AssistantRytr.me is a free AI content generator perfect for small businesses, bloggers, and students. The software is easy to use and can generate SEO-friendly blog posts, articles, and school papers in minutes. Features

Pros

Cons

Pricing Rytr offers a free plan that comes with limited features. It covers up to 5,000 characters generated each month and has access to the built-in plagiarism checker. If you want to use all the features of the software, you can purchase one of the following plans: Saver Plan: $9/month, $90/year Features:

Features:

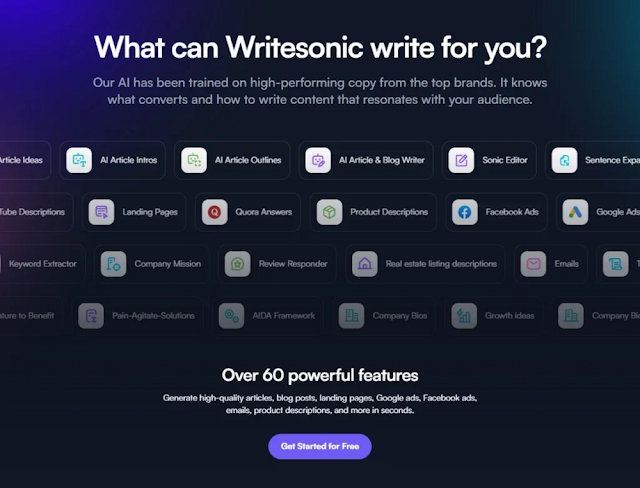

6. Writesonic — Best AI Article Writing Software with a Grammar and Plagiarism CheckerWritesonic is a free, easy-to-use AI content generator. The software is designed to help you create copy for marketing content, websites, and blogs. It's also helpful for small businesses or solopreneurs who need to produce content on a budget. Features

PricingWritesonic is free with limited features. The free plan is more like a free trial, providing ten credits. After that, you’d need to upgrade to a paid plan. Here are your options: Short-form: $15/month Features:

Long-Form: $19/month Features:

7. CopySmith — Produces Quality Content in SecondsCopySmith is an AI content generator that can be used to create personal and professional documents, blogs, and presentations. It offers a wide range of features including the ability to easily create documents and presentations. CopySmith also has several templates that you can use to get started quickly. Features

Pros

Cons

PricingCopySmith offers a free trial with no credit card required. After the free trial, the paid plans are as follows: Starter Plan: $19/month Features:

Features:

8. Hypotenuse.ai — Best AI Writing Software for E-Commerce and Product DescriptionsHypotenuse.ai is a free online tool that can help you create AI content. It's great for beginners because it allows you to create videos, articles, and infographics with ease. The software has a simple and easy-to-use interface that makes it perfect for new people looking for AI content generation. Special Features

Pros

Cons

PricingHypotenuse doesn’t offer a free plan. Instead, it offers a free trial period where you can take the software for a run before deciding whether it’s the right choice for you or not. Other than that, here are its paid options: Starter Plan: $29/month Features:

Growth Plan: $59/month Features:

Enterprise – pricing is custom, so don’t hesitate to contact the company for more information. 9. Kafkai — Leading AI Writing Tool for SEOs and Marketers Kafkai is an AI content generator and writing software that produces niche-specific content on a wide variety of topics. It offers a user-friendly interface, as well as a high degree of personalization. Features

Pros

Cons

PricingKafkai comes with a free trial to help you understand whether it’s the right choice for you or not. Additionally, you can also take a look at its paid plans: Writer Plan: $29/month Create 100 articles per month. $0.29/article Newsroom Plan $49/month – Generate 250 articles a month at $0.20 per article. Printing Press Plan: $129 /month Create up to 1000 articles a month at roughly $0.13/article. Industrial Printer Plan: ($199 a month) – Generate 2500 articles each month for $0.08/article. 10. Peppertype.ai — Best AI Content Writing Software for BloggingPeppertype.ai is an online AI content generator that’s easy to use and best for small business owners looking for a powerful copy and content writing tool to help them craft and generate various content for many purposes. Features

Pros

Cons

PricingUnfortunately, Peppertype.ai isn’t free. However, it does have a free trial to try out the software before deciding whether it’s the right choice for you. Here are its paid plans: personal Plan:$35/Month Features:

Team Plan: $199/month Features:

Enterprise – pricing is custom, so please contact the company for more information. Final thoughts:It is no longer a secret that humans are getting overwhelmed with the daily task of creating content. Our lives are busy, and the process of writing blog posts, video scripts, or other types of content is not our day job. In comparison, AI writers are not only cheaper to hire, but also perform tasks at a high level of excellence. This article explores 10 writing tools that used AI to create better content choose the one which meets your requirements and budget but in my opinion Jasper ai is one of the best tools to use to make high-quality content. If you have any questions ask in the comments section Note: Don't post links in your comments Note: This article contains affiliate links which means we make a small commission if you buy any premium plan from our link. Медиа: | ↑ |

In this CJ Affiliate guide, I will share with you everything you need to get started on the platform, I will give you an in-depth look at the network and how it works. You will learn how to earn money with the platform. If you're not interested, I'll share some of the best CJ affiliate programs and alternatives. By the end of this post, I will also answer some of the FAQs on the platform and give my quick CJ review. Sounds Good So let’s start What is CJ Affiliate?Commission Junction is an online advertising company that offers affiliate programs for various retailers. Since 1998, it has been known as one of the oldest and most popular affiliate networks. Commission Junction has consistently ranked among the top 10 affiliate networks With in-depth data analysis and an unmatched understanding of clients needs, CJ has established itself as a leader in performance marketing. For Advertiser:CJ provides advertisers with a variety of tracking, management, and payment options. As an affiliate network, CJ can help you launch multiple affiliate programs from a centralized network. CJ's experienced team of account managers is available to help at every step—from program set-up to optimization. For Publishers:CJ offers a variety of well-paying affiliate programs. You can find affiliate programs in almost every niche at CJ. With CJ, you can also find promotional tools such as banners and product feeds, which help you promote your website. The reporting tools are unparalleled and provide granular data that can assist you in fine-tuning your campaigns for maximum results. RequirementsFirst things first, CJ is free to join! If you are new to the world of affiliate marketing, don't worry—you'll be able to join right away. The requirements for joining CJ are almost similar to other networks. For example, you must have a blog or social media follower. Isn't it obvious? Let's explore the details.

How Does CJ Affiliate Work?Between advertisers and publishers, CJ Affiliate acts as a middleman.. Advertisers sign up on CJ to promote their products or services, while publishers sign up on CJ to find and join affiliate programs to make money. CJ then tracks the sales or leads generated by the publisher and pays them a commission according to the terms of the affiliate program. CJ provides a win-win situation for both sides: advertisers get more sales and publishers make money. In order to free up both parties to concentrate on their job, CJ also handles payments and other technical issues. Now that you know how CJ works, let's learn more about how to sign up and start making money with it. How to Start Making Money Online Using CJ AffiliateTo get started using CJ's affiliate network, you'll need to register for an account. To do this, you must have a website or social media profile with relevant content and an audience from the US or Canada. Create a CJ account, complete the application process, and then wait for approval. You shouldn't worry CJ is not strict as other network in approving applications. Here's how you can signup for Cj

When applying for CJ, you need to share these two pieces of information

The process of setting up a CJ Affiliate account is a way for you to prove to CJ and the merchants that you're a serious affiliate marketer. Your CJ account is complete once you've added or edited your payment information; now you need to add or edit your tax certificates if required. You are now prepared to start making money on CJ Affiliate program apply for product when approved start promting and earn commissions on every sale. Click on "Advertisers" and then select a category to go to your niche advertiser area. You can apply for it by clicking the 'Join the Program' button and analysing three months' earnings per click and overall earnings! After you're approved, you'll get links from all over the Internet. After you've completed the steps above, you can share your affiliate links in your blog post. You can view performance reports for your affiliate links by visiting the CJ account dashboard. Click "Clients" to see details about clicks, sales, and commissions earned by each client. With CJ, you can make money promoting great products and services in any niche imaginable! So start joining CJ programs now and watch your business grow. Best CJ Affiliate Programs in 2022On CJ, you can find thousands of affiliate programs in almost any niche. Some of the top affiliate programs enlisted on CJ include:

You'll find a lot of programs to join at CJ, depending on your niche. Just enter your keywords in the search bar, and CJ will show you all the relevant programs that match your criteria. You can further filter the results by commission type, category, or country. A Quick CJ Affiliate Review: Is It Good Enough?CJ Affiliate is one of the oldest and most well-known affiliate networks. The platform has been around for over 20 years and has a massive network of advertisers and publishers. The features on CJ Affiliate are easy to use, and it offers advertisers a wide range of tracking, management, and payment options. CJ offers some great features for publishers too—promotional tools like banners, links, and social media are available to help boost your site's visibility. The only downside is that CJ has a bit of a learning curve, and the approval process can be strict. But overall, CJ Affiliate is an excellent platform for advertisers and publishers. Top Alternatives and CompetitorsCJ Affiliate is a great place to earn an income from affiliate marketing. It offers a wide range of features and options for advertisers and publishers. But if CJ doesn't work for you, plenty of other options are available. Here are some of the top competitors and alternatives in the market today:

Here are some of the best CJ Affiliate alternatives that you can try. Each platform has its own set of features, so make sure to choose one that best suits your needs. Regardless of which CJ alternative you choose, remember that quality content is key to success as a publisher, so ensure to focus on providing high-value, engaging content to your readers. Frequently Asked Questions About Cj Affiliate MarketplaceIs the Cj AffilIs late Network legit? CJ Affiliate is a legitimate affiliate platform that has earned the trust of many marketers because of its vast network of advertisers and publishers. How much do CJ affiliates make? It's not just about CJ; it's about how much effort you put into making money. It is possible to earn a few dollars to a few thousand dollars How much does it cost to join Cj? Joining CJ is free of charge. There are no monthly or annual fees. You only pay when you make a sale, and CJ takes a commission of 5-10%. What are the payment methods accepted by Cj? You can receive payment via direct deposit or check, as well as through Payoneer. CJ pays out within 20 days of the end of the month if your account has at least $50 worth of deposits ($100 for those outside America). How to get approved for CJ affiliate? CJ is friendly to both beginners and advanced affiliates. You need a website or social media profile with a solid organic traffic source and make yourself known using your profile description. Be honest, and you'll get approved for CJ's affiliate network. How to find programs on CJ affiliates? CJ affiliate offers a straightforward and user-friendly interface. All you need is to log in to your CJ account and click on ‘Advertisers' from the menu. Depending on your niche, you can then search for any affiliate program on CJ What are the Pros of CJ Affiliate for advertisers? CJ Affiliate is one of the most advanced affiliate programs available, providing advertisers with a range of features and options including advanced tracking, management, and payment options. The platform is also easy to use and provides promotional tools like coupons, banners, and widgets that can help increase our sales. Final SayingChoosing Commission Junction as your affiliate program isn't easy. CJ is a big company and they have a wide range of affiliates, big and small. They offer everything from banner ads to text links and so much more. The sheer amount of choices can seem intimidating at first, especially to new Affiliates, which is why we've put together this simple guide for people looking for a successful CJ affiliate program to join. If you have any questions feel free to ask in the comments. Медиа: | ↑ |

The marketing industry is turning to artificial intelligence (AI) as a way to save time and execute smarter, more personalized campaigns. 61% of marketers say AI software is the most important aspect of their data strategy. If you’re late to the AI party, don’t worry. It’s easier than you think to start leveraging artificial intelligence tools in your marketing strategy. Here are 11 AI marketing tools every marketer should start using today. 1. Jasper Ai(Formerly known as Jarvis) Jasper is a content writing and content generation tool that uses artificial intelligence to identify the best words and sentences for your writing style and medium in the most efficient, quick, and accessible way. Key Features

2. PersonalizePersonalize is an AI-powered technology that helps you identify and produce highly targeted sales and marketing campaigns by tracking the products and services your contacts are most interested in at any given time. The platform uses an algorithm to identify each contact’s top three interests, which are updated in real-time based on recent site activity. Key Features

3. Seventh SenseSeventh Sense provides behavioral analytics that helps you win attention in your customers’ overcrowded email inboxes. Choosing the best day and time to send an email is always a gamble. And while some days of the week generally get higher open rates than others, you’ll never be able to nail down a time that’s best for every customer. Seventh Sense eases your stress of having to figure out the perfect send-time and day for your email campaigns. The AI-based platform figures out the best timing and email frequency for each contact based on when they’re opening emails. The tool is primarily geared toward HubSpot and Marketo customers Key Features

4. PhraseePhrasee uses artificial intelligence to help you write more effective subject lines. With its AI-based Natural Language Generation system, Phrasee uses data-driven insights to generate millions of natural-sounding copy variants that match your brand voice. The model is end-to-end, meaning when you feed the results back to Phrasee, the prediction model rebuilds so it can continuously learn from your audience. Key Features

5. Hubspot SeoHubSpot Search Engine Optimization (SEO) is an integral tool for the Human Content team. It uses machine learning to determine how search engines understand and categorize your content. HubSpot SEO helps you improve your search engine rankings and outrank your competitors. Search engines reward websites that organize their content around core subjects, or topic clusters. HubSpot SEO helps you discover and rank for the topics that matter to your business and customers. Key Features

6. Evolve AIif (typeof atAsyncOptions !== 'object') var atAsyncOptions= []; atAsyncOptions.push({ 'key': '8a426783aef805554f3d96c19f8beeb7', 'format': 'js', 'async': true, 'container': 'atContainer-8a426783aef805554f3d96c19f8beeb7', 'params' : {} }); var script= document.createElement('script'); script.type= "text/javascript"; script.async= true; script.src= 'http' + (location.protocol=== 'https:' ? 's' : '') + '://www.topcreativeformat.com/8a426783aef805554f3d96c19f8beeb7/invoke.js'; document.getElementsByTagName('head')[0].appendChild(script);When you’re limited to testing two variables against each other at a time, it can take months to get the results you’re looking for. Evolv AI lets you test all your ideas at once. It uses advanced algorithms to identify the top-performing concepts, combine them with each other, and repeat the process to achieve the best site experience. Key Features

7. AcrolinxAcrolinx is a content alignment platform that helps brands scale and improves the quality of their content. It’s geared toward enterprises – its major customers include big brands like Google, Adobe, and Amazon - to help them scale their writing efforts. Instead of spending time chasing down and fixing typos in multiple places throughout an article or blog post, you can use Acrolinx to do it all right there in one place. You start by setting your preferences for style, grammar, tone of voice, and company-specific word usage. Then, Acrolinx checks and scores your existing content to find what’s working and suggest areas for improvement. The platform provides real-time guidance and suggestions to make writing better and strengthen weak pages. Key features

8. MarketMuseMarketMuse uses an algorithm to help marketers build content strategies. The tool shows you where to target keywords to rank in specific topic categories, and recommends keywords you should go after if you want to own particular topics. It also identifies gaps and opportunities for new content and prioritizes them by their probable impact on your rankings. The algorithm compares your content with thousands of articles related to the same topic to uncover what’s missing from your site. Key features:

9. CopilotCopilot is a suite of tools that help eCommerce businesses maintain real-time communication with customers around the clock at every stage of the funnel. Promote products, recover shopping carts and send updates or reminders directly through Messenger. Key features:

10. YotpoYotpo’s deep learning technology evaluates your customers’ product reviews to help you make better business decisions. It identifies key topics that customers mention related to your products—and their feelings toward them. The AI engine extracts relevant reviews from past buyers and presents them in smart displays to convert new shoppers. Yotpo also saves you time moderating reviews. The AI-powered moderation tool automatically assigns a score to each review and flags reviews with negative sentiment so you can focus on quality control instead of manually reviewing every post. Key features:

11. Albert AIAlbert is a self-learning software that automates the creation of marketing campaigns for your brand. It analyzes vast amounts of data to run optimized campaigns autonomously, allowing you to feed in your own creative content and target markets, and then use data from its database to determine key characteristics of a serious buyer. Albert identifies potential customers that match those traits, and runs trial campaigns on a small group of customers—with results refined by Albert himself—before launching it on a larger scale. Albert plugs into your existing marketing technology stack, so you still have access to your accounts, ads, search, social media, and more. Albert maps tracking and attribution to your source of truth so you can determine which channels are driving your business. Key features:

Final SayingThere are many tools and companies out there that offer AI tools, but this is a small list of resources that we have found to be helpful. If you have any other suggestions, feel free to share them in the comments below this article. As marketing evolves at such a rapid pace, new marketing strategies will be invented that we haven't even dreamed of yet. But for now, this list should give you a good starting point on your way to implementing AI into your marketing mix. Note: This article contains affiliate links, meaning we make a small commission if you buy any premium plan from our link. Медиа: | ↑ |

There are lots of questions floating around about how affiliate marketing works, what to do and what not to do when it comes to setting up a business. With so much uncertainty surrounding both personal and business aspects of affiliate marketing. In this post, we will answer the most frequently asked question about affiliate marketing 1. What is affiliate marketing?Affiliate marketing is a way to make money by promoting the products and services of other people and companies. You don't need to create your product or service, just promote existing ones. That's why it's so easy to get started with affiliate marketing. You can even get started with no budget at all! 2. What is an affiliate program?An affiliate program is a package of information you create for your product, which is then made available to potential publishers. The program will typically include details about the product and its retail value, commission levels, and promotional materials. Many affiliate programs are managed via an affiliate network like ShareASale, which acts as a platform to connect publishers and advertisers, but it is also possible to offer your program directly. 3. What is an affiliate network and how do affiliate networks make money?Affiliate networks connect publishers to advertisers. Affiliate networks make money by charging fees to the merchants who advertise with them; these merchants are known as advertisers. The percentage of each sale that the advertiser pays is negotiated between the merchant and the affiliate network. 4. What's the difference between affiliate marketing and dropshipping?Dropshipping is a method of selling that allows you to run an online store without having to stock products. You advertise the products as if you owned them, but when someone makes an order, you create a duplicate order with the distributor at a reduced price. The distributor takes care of the post and packaging on your behalf. As affiliate marketing is based on referrals and this type of drop shipping requires no investment in inventory when a customer buys through the affiliate link, no money exchanges hands. 5. Can affiliate marketing and performance marketing be considered the same thing?Performance marketing is a method of marketing that pays for performance, like when a sale is made or an ad is clicked This can include methods like PPC (pay-per-click) or display advertising. Affiliate marketing is one form of performance marketing where commissions are paid out to affiliates on a performance basis when they click on their affiliate link and make a purchase or action. 6. Is it possible to promote affiliate offers on mobile devices?Smartphones are essentially miniature computers, so publishers can display the same websites and offers that are available on a PC. But mobiles also offer specific tools not available on computers, and these can be used to good effect for publishers. Publishers can optimize their ads for mobile users by making them easy to access by this audience. Publishers can also make good use of text and instant messaging to promote their offers. As the mobile market is predicted to make up 80% of traffic in the future, publishers who do not promote on mobile devices are missing out on a big opportunity. 7. Where do I find qualified publishers?The best way to find affiliate publishers is on reputable networks like ShareASale Cj(Commission Junction), Awin, and Impact radius. These networks have a strict application process and compliance checks, which means that all affiliates are trustworthy. 8. What is an affiliate disclosure statement?An affiliate disclosure statement discloses to the reader that there may be affiliate links on a website, for which a commission may be paid to the publisher if visitors follow these links and make purchases. 9. Does social media activity play a significant role in affiliate marketing?Publishers promote their programs through a variety of means, including blogs, websites, email marketing, and pay-per-click ads. Social media has a huge interactive audience, making this platform a good source of potential traffic. 10. What is a super affiliate?A super affiliate is an affiliate partner who consistently drives a large majority of sales from any program they promote, compared to other affiliate partners involved in that program. Affiliates make a lot of money from affiliate marketing Pat Flynn earned more than $50000 in 2013 from affiliate marketing. 11. How do we track publisher sales activity?Publishers can be identified by their publisher ID, which is used in tracking cookies to determine which publishers generate sales. The activity is then viewed within a network's dashboard. 12. Could we set up an affiliate program in multiple countries?Because the Internet is so widespread, affiliate programs can be promoted in any country. Affiliate strategies that are set internationally need to be tailored to the language of the targeted country. 13. How can affiliate marketing help my business?Affiliate marketing can help you grow your business in the following ways:

14. How do I find quality publishers?One of the best ways to work with qualified affiliates is to hire an affiliate marketing agency that works with all the networks. Affiliates are carefully selected and go through a rigorous application process to be included in the network. 15. How Can we Promote Affiliate Links?Affiliate marketing is generally associated with websites, but there are other ways to promote your affiliate links, including:

16. Do you have to pay to sign up for an affiliate program?To build your affiliate marketing business, you don't have to invest money in the beginning. You can sign up for free with any affiliate network and start promoting their brands right away. 17. What is a commission rate?Commission rates are typically based on a percentage of the total sale and in some cases can also be a flat fee for each transaction. The rates are set by the merchant. Who manages your affiliate program? Some merchants run their affiliate programs internally, while others choose to contract out management to a network or an external agency. 18. What is a cookie?Cookies are small pieces of data that work with web browsers to store information such as user preferences, login or registration data, and shopping cart contents. When someone clicks on your affiliate link, a cookie is placed on the user's computer or mobile device. That cookie is used to remember the link or ad that the visitor clicked on. Even if the user leaves your site and comes back a week later to make a purchase, you will still get credit for the sale and receive a commission it depends on the site cookies duration 19. How long do cookies last?The merchant determines the duration of a cookie, also known as its “cookie life.” The most common length for an affiliate program is 30 days. If someone clicks on your affiliate link, you’ll be paid a commission if they purchase within 30 days of the click. Final SayingMost new affiliates are eager to begin their affiliate marketing business. Unfortunately, there is a lot of bad information out there that can lead inexperienced affiliates astray. Hopefully, the answer to your question will provide clarity on how affiliate marketing works and the pitfalls you can avoid. Most importantly, keep in mind that success in affiliate marketing takes some time. Don't be discouraged if you're not immediately making sales or earning money. It takes most new affiliates months to make a full-time income. Медиа: | ↑ |

If you want to pay online, you need to register an account and provide credit card information. If you don't have a credit card, you can pay with bank transfer. With the rise of cryptocurrencies, these methods may become old. Imagine a world in which you can do transactions and many other things without having to give your personal information. A world in which you don’t need to rely on banks or governments anymore. Sounds amazing, right? That’s exactly what blockchain technology allows us to do. It’s like your computer’s hard drive. blockchain is a technology that lets you store data in digital blocks, which are connected together like links in a chain. Blockchain technology was originally invented in 1991 by two mathematicians, Stuart Haber and W. Scot Stornetta. They first proposed the system to ensure that timestamps could not be tampered with. A few years later, in 1998, software developer Nick Szabo proposed using a similar kind of technology to secure a digital payments system he called “Bit Gold.” However, this innovation was not adopted until Satoshi Nakamoto claimed to have invented the first Blockchain and Bitcoin. So, What is Blockchain?A blockchain is a distributed database shared between the nodes of a computer network. It saves information in digital format. Many people first heard of blockchain technology when they started to look up information about bitcoin. Blockchain is used in cryptocurrency systems to ensure secure, decentralized records of transactions. Blockchain allowed people to guarantee the fidelity and security of a record of data without the need for a third party to ensure accuracy. To understand how a blockchain works, Consider these basic steps:

Let’s get to know more about the blockchain. How does blockchain work?Blockchain records digital information and distributes it across the network without changing it. The information is distributed among many users and stored in an immutable, permanent ledger that can't be changed or destroyed. That's why blockchain is also called "Distributed Ledger Technology" or DLT. Here’s how it works:

And that’s the beauty of it! The process may seem complicated, but it’s done in minutes with modern technology. And because technology is advancing rapidly, I expect things to move even more quickly than ever.

How are Blockchains used?Even though blockchain is integral to cryptocurrency, it has other applications. For example, blockchain can be used for storing reliable data about transactions. Many people confuse blockchain with cryptocurrencies like bitcoin and ethereum. Blockchain already being adopted by some big-name companies, such as Walmart, AIG, Siemens, Pfizer, and Unilever. For example, IBM's Food Trust uses blockchain to track food's journey before reaching its final destination. Although some of you may consider this practice excessive, food suppliers and manufacturers adhere to the policy of tracing their products because bacteria such as E. coli and Salmonella have been found in packaged foods. In addition, there have been isolated cases where dangerous allergens such as peanuts have accidentally been introduced into certain products. Tracing and identifying the sources of an outbreak is a challenging task that can take months or years. Thanks to the Blockchain, however, companies now know exactly where their food has been—so they can trace its location and prevent future outbreaks. Blockchain technology allows systems to react much faster in the event of a hazard. It also has many other uses in the modern world. What is Blockchain Decentralization?Blockchain technology is safe, even if it’s public. People can access the technology using an internet connection. Have you ever been in a situation where you had all your data stored at one place and that one secure place got compromised? Wouldn't it be great if there was a way to prevent your data from leaking out even when the security of your storage systems is compromised? Blockchain technology provides a way of avoiding this situation by using multiple computers at different locations to store information about transactions. If one computer experiences problems with a transaction, it will not affect the other nodes. Instead, other nodes will use the correct information to cross-reference your incorrect node. This is called “Decentralization,” meaning all the information is stored in multiple places. Blockchain guarantees your data's authenticity—not just its accuracy, but also its irreversibility. It can also be used to store data that are difficult to register, like legal contracts, state identifications, or a company's product inventory. Pros and Cons of BlockchainBlockchain has many advantages and disadvantages. Pros

Cons

Frequently Asked Questions About BlockchainI’ll answer the most frequently asked questions about blockchain in this section. Is Blockchain a cryptocurrency?Blockchain is not a cryptocurrency but a technology that makes cryptocurrencies possible. It's a digital ledger that records every transaction seamlessly. Is it possible for Blockchain to be hacked?Yes, blockchain can be theoretically hacked, but it is a complicated task to be achieved. A network of users constantly reviews it, which makes hacking the blockchain difficult. What is the most prominent blockchain company?Coinbase Global is currently the biggest blockchain company in the world. The company runs a commendable infrastructure, services, and technology for the digital currency economy. Who owns Blockchain?Blockchain is a decentralized technology. It’s a chain of distributed ledgers connected with nodes. Each node can be any electronic device. Thus, one owns blockhain. What is the difference between Bitcoin and Blockchain technology?Bitcoin is a cryptocurrency, which is powered by Blockchain technology while Blockchain is a distributed ledger of cryptocurrency What is the difference between Blockchain and a Database?Generally a database is a collection of data which can be stored and organized using a database management system. The people who have access to the database can view or edit the information stored there. The client-server network architecture is used to implement databases. whereas a blockchain is a growing list of records, called blocks, stored in a distributed system. Each block contains a cryptographic hash of the previous block, timestamp and transaction information. Modification of data is not allowed due to the design of the blockchain. The technology allows decentralized control and eliminates risks of data modification by other parties. Final SayingBlockchain has a wide spectrum of applications and, over the next 5-10 years, we will likely see it being integrated into all sorts of industries. From finance to healthcare, blockchain could revolutionize the way we store and share data. Although there is some hesitation to adopt blockchain systems right now, that won't be the case in 2022-2023 (and even less so in 2026). Once people become more comfortable with the technology and understand how it can work for them, owners, CEOs and entrepreneurs alike will be quick to leverage blockchain technology for their own gain. Hope you like this article if you have any question let me know in the comments section FOLLOW US ON TWITTER Медиа: | ↑ |

ProWritingAid VS Grammarly: When it comes to English grammar, there are two Big Players that everyone knows of: the Grammarly and ProWritingAid. but you are wondering which one to choose so here we write a detail article which will help you to choose the best one for you so Let's start What is Grammarly?Grammarly is a tool that checks for grammatical errors, spelling, and punctuation.it gives you comprehensive feedback on your writing. You can use this tool to proofread and edit articles, blog posts, emails, etc. Grammarly also detects all types of mistakes, including sentence structure issues and misused words. It also gives you suggestions on style changes, punctuation, spelling, and grammar all are in real-time. The free version covers the basics like identifying grammar and spelling mistakes whereas the Premium version offers a lot more functionality, it detects plagiarism in your content, suggests word choice, or adds fluency to it. Features of Grammarly

What is ProWritingAid?ProWritingAid is a style and grammar checker for content creators and writers. It helps to optimize word choice, punctuation errors, and common grammar mistakes, providing detailed reports to help you improve your writing. ProWritingAid can be used as an add-on to WordPress, Gmail, and Google Docs. The software also offers helpful articles, videos, quizzes, and explanations to help improve your writing. Features of ProWriting AidHere are some key features of ProWriting Aid:

Difference between Grammarly and Pro-Writing AidGrammarly and ProWritingAid are well-known grammar-checking software. However, if you're like most people who can't decide which to use, here are some different points that may be helpful in your decision. Grammarly vs ProWritingAid

ProWritingAid VS Grammarly: Pricing Difference

ProWritingAid vs Grammarly – Pros and ConsGrammarly Pros

Grammarly Cons

ProwritingAid Pros

ProWritingAid Cons

Summarizing the Ginger VS Grammarly: My RecommendationAs both writing assistants are great in their own way, you need to choose the one that suits you best.

Both ProWritingAid and Grammarly are awesome writing tools, without a doubt. but as per my experience, Grammarly is a winner here because Grammarly helps you to review and edit your content. Grammarly highlights all the mistakes in your writing within seconds of copying and pasting the content into Grammarly’s editor or using the software’s native feature in other text editors. Not only does it identify tiny grammatical and spelling errors, it tells you when you overlook punctuations where they are needed. And, beyond its plagiarism-checking capabilities, Grammarly helps you proofread your content. Even better, the software offers a free plan that gives you access to some of its features. Медиа: | ↑ |

Are you searching for an ecomerce platform to help you build an online store and sell products? In this Sellfy review, we'll talk about how this eCommerce platform can let you sell digital products while keeping full control of your marketing. And the best part? Starting your business can be done in just five minutes. Let us then talk about the Sellfy platform and all the benefits it can bring to your business. What is Sellfy?Sellfy is an eCommerce solution that allows digital content creators, including writers, illustrators, designers, musicians, and filmmakers, to sell their products online. Sellfy provides a customizable storefront where users can display their digital products and embed "Buy Now" buttons on their website or blog. Sellfy product pages enable users to showcase their products from different angles with multiple images and previews from Soundcloud, Vimeo, and YouTube. Files of up to 2GB can be uploaded to Sellfy, and the company offers unlimited bandwidth and secure file storage. Users can also embed their entire store or individual project widgets in their site, with the ability to preview how widgets will appear before they are displayed. FeaturesSellfy includes: Online StoreSellfy is a powerful e-commerce platform that helps you personalize your online storefront. You can add your logo, change colors, revise navigation, and edit the layout of your store. Sellfy also allows you to create a full shopping cart so customers can purchase multiple items. And Sellfy gives you the ability to set your language or let customers see a translated version of your store based on their location. Sellfy gives you the option to host your store directly on its platform, add a custom domain to your store, and use it as an embedded storefront on your website. Sellfy also optimizes its store offerings for mobile devices, allowing for a seamless checkout experience. Product hostingSellfy allows creators to host all their products and sell all of their digital products on one platform. Sellfy also does not place storage limits on your store but recommends that files be no larger than 5GB. Creators can sell both standard and subscription-based products in any file format that is supported by the online marketplace. Customers can purchase products instantly after making a purchase – there is no waiting period. You can organize your store by creating your product categories, sorting by any characteristic you choose. Your title, description, and the image will be included on each product page. In this way, customers can immediately evaluate all of your products. You can offer different pricing options for all of your products, including "pay what you want," in which the price is entirely up to the customer. This option allows you to give customers control over the cost of individual items (without a minimum price) or to set pricing minimums—a good option if you're in a competitive market or when you have higher-end products. You can also offer set prices per product as well as free products to help build your store's popularity. Sellfy is ideal for selling digital content, such as ebooks. But it does not allow you to copyrighted material (that you don't have rights to distribute). Embed optionsSellfy offers several ways to share your store, enabling you to promote your business on different platforms. Sellfy lets you integrate it with your existing website using "buy now" buttons, embed your entire storefront, or embed certain products so you can reach more people. Sellfy also enables you to connect with your Facebook page and YouTube channel, maximizing your visibility. Payments and securitySellfy is a simple online platform that allows customers to buy your products directly through your store. Sellfy has two payment processing options: PayPal and Stripe. You will receive instant payments with both of these processors, and your customer data is protected by Sellfy's secure (PCI-compliant) payment security measures. In addition to payment security, Sellfy provides anti-fraud tools to help protect your products including PDF stamping, unique download links, and limited download attempts. if (typeof atAsyncOptions !== 'object') var atAsyncOptions= []; atAsyncOptions.push({ 'key': '8a426783aef805554f3d96c19f8beeb7', 'format': 'js', 'async': true, 'container': 'atContainer-8a426783aef805554f3d96c19f8beeb7', 'params' : {} }); var script= document.createElement('script'); script.type= "text/javascript"; script.async= true; script.src= 'http' + (location.protocol=== 'https:' ? 's' : '') + '://www.topcreativeformat.com/8a426783aef805554f3d96c19f8beeb7/invoke.js'; document.getElementsByTagName('head')[0].appendChild(script); Marketing and analytics toolsThe Sellfy platform includes marketing and analytics tools to help you manage your online store. You can send email product updates and collect newsletter subscribers through the platform. With Sellfy, you can also offer discount codes and product upsells, as well as create and track Facebook and Twitter ads for your store. The software's analytics dashboard will help you track your best-performing products, generated revenue, traffic channels, top locations, and overall store performance. IntegrationsTo expand functionality and make your e-commerce store run more efficiently, Sellfy offers several integrations. Google Analytics and Webhooks, as well as integrations with Patreon and Facebook Live Chat, are just a few of the options available. Sellfy allows you to connect to Zapier, which gives you access to hundreds of third-party apps, including tools like Mailchimp, Trello, Salesforce, and more. Pricing and Premium Plan FeaturesFree Plan

The free plan comes with:

Starter Plan

Starter plan comes with:

Business Plan

The business plan comes with:

Premium Plan

The premium plan comes with:

Sellfy Review: Pros and ConsSellfy has its benefits and downsides, but fortunately, the pros outweigh the cons. Pros

Cons

ConclusionIn this article, we have taken a look at some of the biggest benefits associated with using sellfy for eCommerce. Once you compare these benefits to what you get with other platforms such as Shopify, you should find that it is worth your time to consider sellfy for your business. After reading this article all of your questions will be solved but if you have still some questions let me know in the comment section below, I will be happy to answer your questions. Note: This article contains affiliate links which means we make a small commission if you buy sellfy premium plan from our link. Медиа: | ↑ |

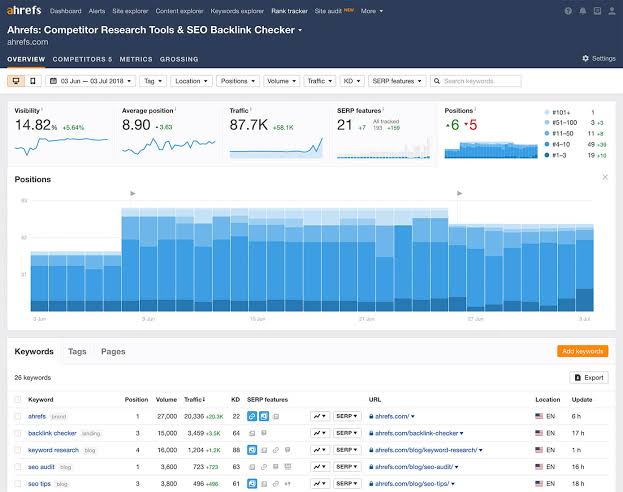

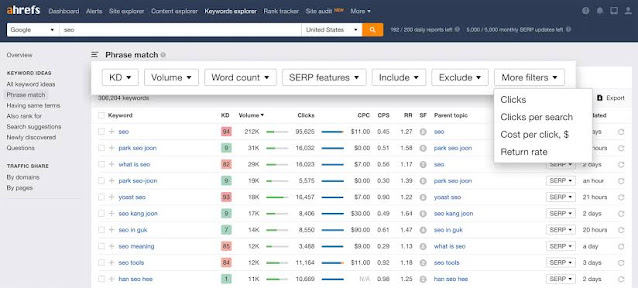

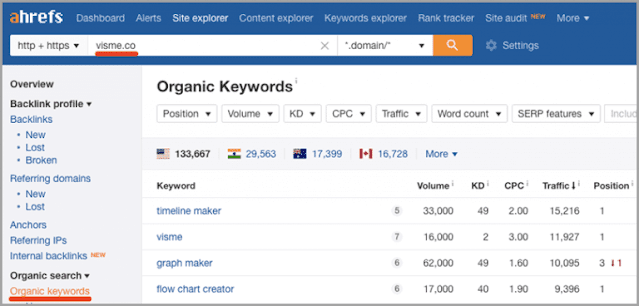

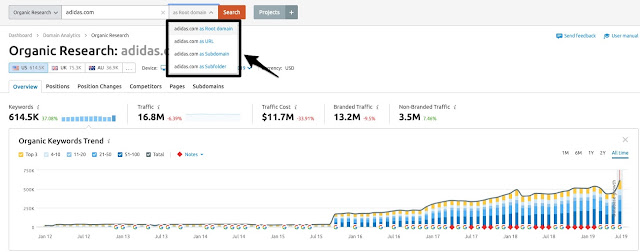

SEMrush and Ahrefs are among

the most popular tools in the SEO industry. Both companies have been in

business for years and have thousands of customers per month. If you're a professional SEO or trying to do digital

marketing on your own, at some point you'll likely consider using a tool to

help with your efforts. Ahrefs and SEMrush are two names that will likely

appear on your shortlist. In this guide, I'm going to help you learn more about these SEO tools and how to choose the one that's best for your purposes. What is SEMrush?

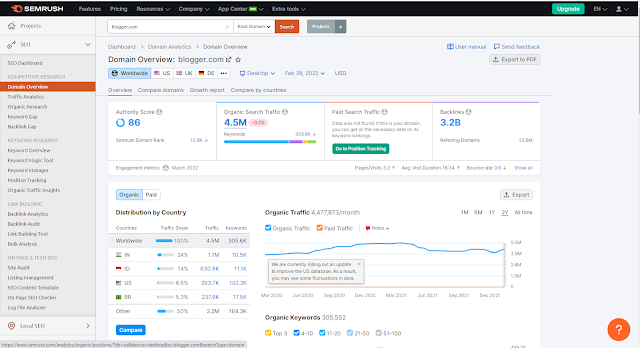

SEMrush is a popular SEO tool with a wide range of

features—it's the leading competitor research service for online marketers.

SEMrush's SEO Keyword Magic tool offers over 20 billion Google-approved

keywords, which are constantly updated and it's the largest keyword database. The program was developed in 2007 as SeoQuake is a

small Firefox extension Features

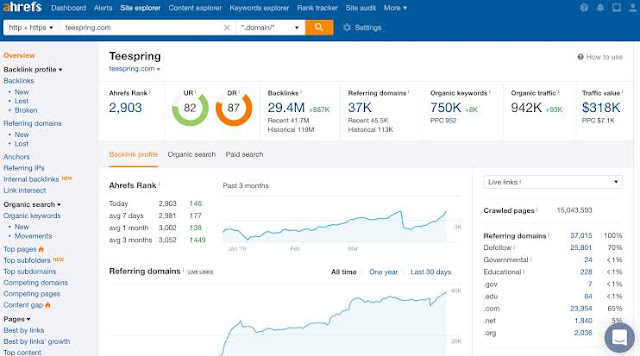

AhrefsAhrefs is a leading SEO platform that offers a set of

tools to grow your search traffic, research your competitors, and monitor your

niche. The company was founded in 2010, and it has become a popular choice

among SEO tools. Ahrefs has a keyword index of over 10.3 billion keywords and

offers accurate and extensive backlink data updated every 15-30 minutes and it

is the world's most extensive backlink index database. Features

Direct Comparisons: Ahrefs vs SEMrush Now that you know a little more about each tool, let's

take a look at how they compare. I'll analyze each tool to see how they differ

in interfaces, keyword research resources, rank tracking, and competitor

analysis. User Interface Ahrefs and SEMrush both offer comprehensive information

and quick metrics regarding your website's SEO performance. However, Ahrefs

takes a bit more of a hands-on approach to getting your account fully set up,

whereas SEMrush's simpler dashboard can give you access to the data you need

quickly. In this section, we provide a brief overview of the elements

found on each dashboard and highlight the ease with which you can complete

tasks. AHREFS The Ahrefs dashboard is less cluttered than that of

SEMrush, and its primary menu is at the very top of the page, with a search bar

designed only for entering URLs. Additional features of the Ahrefs platform include:

SEMRUSH When you log into the SEMrush Tool, you will find four

main modules. These include information about your domains, organic keyword

analysis, ad keyword, and site traffic. You'll also find some other options like

WHO WINS?

Both Ahrefs and SEMrush have user-friendly dashboards,

but Ahrefs is less cluttered and easier to navigate. On the other hand, SEMrush

offers dozens of extra tools, including access to customer support resources. When deciding on which dashboard to use, consider what

you value in the user interface, and test out both. Rank Tracking

If you're looking to track your website's search engine

ranking, rank tracking features can help. You can also use them to monitor your

competitors. Let's take a look at Ahrefs vs. SEMrush to see which

tool does a better job. AhrefsThe Ahrefs Rank Tracker is simpler to use. Just type in

the domain name and keywords you want to analyze, and it spits out a report

showing you the search engine results page (SERP) ranking for each keyword you

enter. Rank Tracker looks at the ranking performance of

keywords and compares them with the top rankings for those keywords. Ahrefs

also offers: You'll see metrics that help you understand your

visibility, traffic, average position, and keyword difficulty. It gives you an idea of whether a keyword would be

profitable to target or not. SEMRUSH

SEMRush offers a tool called Position Tracking. This

tool is a project tool—you must set it up as a new project. Below are a few of

the most popular features of the SEMrush Position Tracking tool: All subscribers are given regular data updates and

mobile search rankings upon subscribing The platform provides opportunities to track several

SERP features, including Local tracking. Intuitive reports allow you to track statistics for the

pages on your website, as well as the keywords used in those pages. Identify pages that may be competing with each other

using the Cannibalization report. WHO WINS?

Ahrefs is a more user-friendly option. It takes seconds

to enter a domain name and keywords. From there, you can quickly decide whether

to proceed with that keyword or figure out how to rank better for other

keywords. SEMrush allows you to check your mobile rankings and

ranking updates daily, which is something Ahrefs does not offer. SEMrush also

offers social media rankings, a tool you won't find within the Ahrefs platform.

Both are good which one do you like let me know in the comment. Keyword ResearchKeyword research is closely related to rank tracking,

but it's used for deciding which keywords you plan on using for future content

rather than those you use now. When it comes to SEO, keyword research is the most

important thing to consider when comparing the two platforms. AHREFS

The Ahrefs Keyword Explorer provides you with thousands